Credit scoring has long been the backbone of the financial industry, determining who gets access to credit and on what terms. Traditional credit scoring methods rely on a limited set of data and rudimentary statistical techniques, often resulting in a rigid and sometimes inaccurate assessment of creditworthiness. However, the advent of machine learning (ML) is poised to revolutionize this space, offering more accurate, dynamic, and inclusive credit score ml models.

Traditional Credit Scoring: Limitations and Challenges

Traditional credit scoring models, such as the FICO score, primarily rely on historical financial data—credit history, outstanding debts, and repayment patterns. These models use linear regression and other basic statistical methods to predict the likelihood of a borrower defaulting on a loan. While effective to some extent, these methods have significant limitations:

- Limited Data Utilization: Traditional models often ignore vast amounts of data that could be relevant to assessing creditworthiness, such as transaction history, social behaviors, and alternative financial data.

- Static Nature: Conventional credit scores are updated infrequently and can fail to reflect real-time changes in a borrower’s financial situation.

- Bias and Discrimination: Reliance on historical data can perpetuate biases, as these models may reflect systemic inequalities present in past lending decisions.

- Lack of Personalization: Traditional scores provide a one-size-fits-all solution, ignoring the unique financial behaviors and circumstances of individual borrowers.

The Promise of Machine Learning

Machine learning offers solutions to many of these limitations by leveraging advanced algorithms and large datasets to create more sophisticated and accurate models. Here’s how ML can revolutionize credit scoring:

-

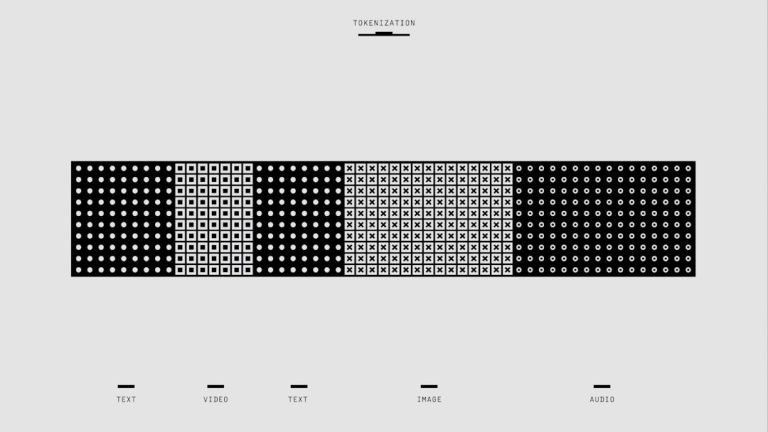

Enhanced Data Utilization

Machine learning models can process and analyze vast amounts of data from various sources, including transaction histories, social media activity, online behavior, and even psychometric data. By incorporating these diverse data points, ML models can provide a more comprehensive and nuanced assessment of creditworthiness.

For instance, a borrower with limited credit history but a consistent record of on-time utility and rent payments can be identified as creditworthy by an ML model, whereas traditional methods might overlook them. This enhanced data utilization makes credit scoring more inclusive, allowing previously underserved populations to gain access to credit.

-

Real-Time Updates

Unlike traditional models, ML algorithms can be updated in real-time as new data becomes available. This dynamic nature ensures that credit scores reflect the most current information about a borrower’s financial behavior. For example, if a borrower suddenly pays off a significant portion of their debt, an ML model can immediately adjust their credit score to reflect this positive change, whereas traditional models might take months to update.

-

Reduction of Bias

Machine learning has the potential to reduce biases in credit scoring by focusing on data-driven insights rather than human judgment. Advanced ML techniques can identify and mitigate the impact of biased data, ensuring that credit decisions are fairer and more equitable. For instance, ML models can be trained to ignore demographic information that has historically led to discrimination and instead focus solely on financial behaviors and patterns.

-

Personalized Credit Scoring

Machine learning allows for the development of personalized credit scoring models that take into account the unique financial behaviors and circumstances of individual borrowers. This personalization can lead to more accurate risk assessments and better loan terms for borrowers. For example, an ML model might recognize that a freelancer’s income is irregular but overall stable and adjust the credit score accordingly, something traditional models would struggle with.

Practical Applications and Case Studies

Several fintech companies and financial institutions are already leveraging machine learning to revolutionize credit scoring. Here are a few examples:

-

ZestFinance

ZestFinance uses machine learning to analyze thousands of data points to assess credit risk. Their model looks beyond traditional credit data, considering factors such as online behavior, employment history, and educational background. This approach has enabled them to provide credit to individuals who might be overlooked by traditional scoring methods.

-

Upstart

Upstart, an online lending platform, employs machine learning algorithms to consider a wide array of factors, including education, employment history, and even standardized test scores, to evaluate creditworthiness. This has allowed them to approve more loans with lower default rates compared to traditional models.

-

LenddoEFL

LenddoEFL leverages alternative data sources, such as mobile phone usage and social media activity, to create credit scores for individuals in emerging markets who lack traditional credit histories. By using machine learning to analyze these unconventional data points, LenddoEFL is able to provide credit to a broader segment of the population.

Challenges and Considerations

While machine learning holds great promise for revolutionizing credit scoring, there are several challenges and considerations to keep in mind:

-

Data Privacy and Security

The use of vast amounts of personal data raises concerns about privacy and security. It is essential for financial institutions to implement robust data protection measures and ensure that borrowers’ data is used ethically and transparently.

-

Algorithmic Transparency

Machine learning models can be complex and difficult to interpret. Ensuring that these models are transparent and that their decisions can be explained to borrowers is crucial for building trust and regulatory compliance.

-

Regulatory Compliance

Financial institutions must navigate a complex regulatory landscape when implementing machine learning in credit scoring. Ensuring that these models comply with existing regulations and standards is essential to avoid legal pitfalls.

-

Mitigating Bias

While machine learning can reduce bias, it is not immune to it. Careful monitoring and testing of ML models are necessary to ensure that they do not perpetuate or amplify existing biases in the data.

The Future of Credit Scoring

The integration of machine learning into credit scoring is still in its early stages, but the potential benefits are immense. As these technologies continue to evolve, we can expect credit scoring models to become more accurate, inclusive, and fair. Financial institutions that embrace machine learning will be better positioned to serve a broader range of customers, reduce default rates, and improve overall financial stability.

In the future, we may see credit scoring models that can adapt to individual financial behaviors in real-time, offering personalized credit solutions that cater to the unique needs of each borrower. This could lead to a more inclusive financial system where access to credit is determined by a comprehensive and fair assessment of one’s ability to repay, rather than a limited and outdated view of their financial history.

In conclusion, machine learning has the potential to revolutionize credit scoring by leveraging advanced algorithms and diverse data sources to create more accurate, dynamic, and inclusive models. While challenges remain, the benefits of this technology are clear, and its adoption will likely lead to a fairer and more efficient credit market.

Comments are closed.