From the inception of trade using the trade by barter system, there has been a need for a means of exchange. This was because the trade by barter system was inaccurate and ended up creating more problems than the ones it solved. From there the use of various items ranging from shells of certain sea creatures to shiny stones, gold, silver and so on.

With modernization came the use of more acceptable jeans of exchange. Modernization saw that every independent state has its own currency that has various denomination with the sole aim of making payments easier.

The recent time has seen a whole new level of means of exchange. These days the use of cash is very much limited as people now prefer to use credit and debit cards for their transactions. This doesn’t in anyway undermine the use of cash. As it will always be important no matter the level of advancement as cash is considered an “on the spot payment medium”. Back to the matter on hand. The use of cards is also getting limited. As there are ATMs that people can withdraw from after verifying their fingerprint.

These advancements have boosted E-commerce development by making transactions easier and faster. Research results gotten by an SEO agency reveals that one of the motivational factors behind the form of payment most preferred is the assurance of security. Below are eight payments feathers for your business that can be termed “made for the future”

Cards

This is one feature that has stood the test of time and will most likely withstand in the near future. This is one feature that has made payment easy and transactions faster. The use of cards is a feature that will not end anytime soon.

Mobile Payments

Show me a bank without a mobile app and I’ll show you a bank that is bent on extinction if it isn’t already extinct. This is one payment feature that is actually made for the future. These days with the click of a button you can purchase goods or pay for services through the use of your mobile phones.

Mobile Wallets

This is quite similar to the mobile bank app but is different because they aren’t limited to a particular bank account or bank. In 2014, Apple was the only major mobile wallet on the market. But in 2015, Google and Samsung launched their own mobile wallets. Walmart, Chase, and other major players also joined the market.

Barcodes

If there is a payment feature capable of substituting for cards. Then it is the use of codes but even the codes most times are actually imprinted on cards. The advantage they have is that you may not necessarily have to carry the card on which your barcode is printed to make payment as a picture or photograph of the barcode could help you make payments. Prominent shopping malls usually use this for their reward cards for customers.

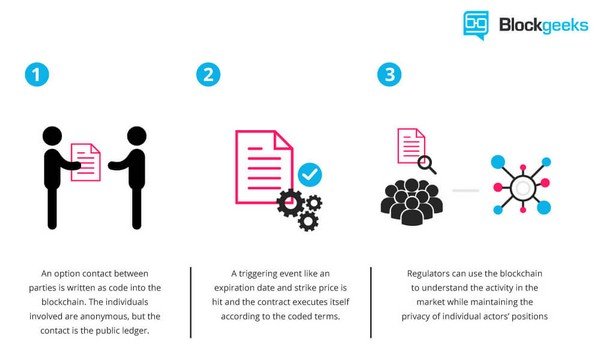

Smart Contracts

A smart contract is a computer protocol intended to digitally facilitate. Verify, or enforce the negotiation or performance of a contract. Smart contracts allow the performance of credible transactions without third parties. These transactions are trackable and irreversible. This is one secure form of making payments as it doesn’t involve any third parties. This will help prevent both parties from becoming victims of fraud.

Cryptocurrencies

This is also in line with smart contracts. This method of payment is a very secure method as information about the transaction are broken down into blocks and stored in distributed ledgers. Cryptocurrency remains a hot commodity in 2018, especially as investors continue to back these digital coins or tokens. However, 2018 may evidence a shift toward the technology undergirding cryptocurrencies with blockchain.

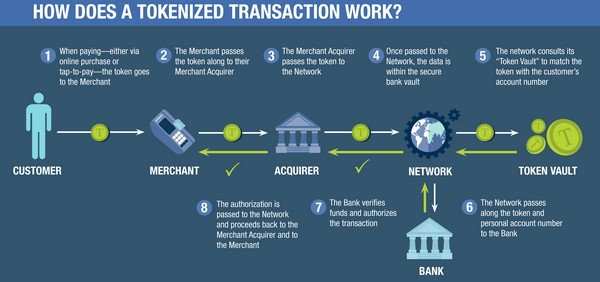

Use of Tokens

The rise of blockchain has brought about the development of various forms of cryptocurrencies. Cryptocurrency created quite the buzz this past year. Although the technology has been around for a few years, 2017 was the year it really took off.

Bitcoin, the first application of cryptocurrency technology, hit $20,000 a coin, while coins like Ethereum also saw their prices increase. However, the technology behind these tokens, blockchain, has far more applications than just cryptocurrencies. These tokens developed by these organizations will serve as their accepted means of exchange.

Mobile Point-On-Sale

This is one feature of payment that is already supporting the use of cards and could support the use of various forms of verification of adequately modified. This will make transactions faster and payment easier not to mention the fact that it will also ensure security.

Comments are closed.